Rate Protection Plan™ at C Krishniah Chetty Group of Jewellers: A Golden Opportunity for 2024

Discover the strategic advantages of adding Gold to your investment portfolio and uncover the most effective methods for investing in this timeless asset. Gold offers diversification benefits, acts as an inflation hedge, and serves as a safe haven during economic uncertainties. Explore various investment avenues, from physical Gold to digital platforms, to tailor your Gold investment approach to your financial objectives and risk tolerance.

Gold continues to be a standout investment, consistently delivering impressive returns. It’s proven to be a resilient asset, with recent performance catching the eye of many investors. Over the past year, Gold’s returns have closely matched those of leading indexes like the Nifty, showcasing gains of around 17-18%, while Nifty posted about 20%. Even looking at three to five-year spans, gold’s performance remains robust.

Given its strong track record, allocating 5-10% of an investment portfolio to commodities, particularly gold, seems prudent. Notably, central banks globally have doubled their typical annual Gold purchases from 1,000 tons to 2,000 tons last year, underscoring the growing demand. Meanwhile, gold production has plateaued at approximately 3,700 tons annually over the last three years, highlighting a significant demand-supply gap.

As we step into 2024, the quest for secure and profitable investment avenues continues to be a priority for savvy investors. Amidst the myriad options available, gold investment emerges as a timeless choice, combining the allure of tangible assets with the promise of steady appreciation. Recognising the unique position of gold in the investment landscape, C. Krishniah Chetty Group of Jewellers introduces a pioneering solution for those looking to navigate the gold market with confidence: the Rate Protection Plan™.

Introducing INDIA’S first Rate Protection Plan™ by C Krishniah Chetty Group Of Jewellers, featuring two groundbreaking schemes designed to secure your investment in precious metals and gems against market volatility:

These innovative schemes empower you to accumulate gold jewellery, diamond & platinum jewellery, and silverware for your entire family, all while bypassing the concerns of fluctuating market rates.

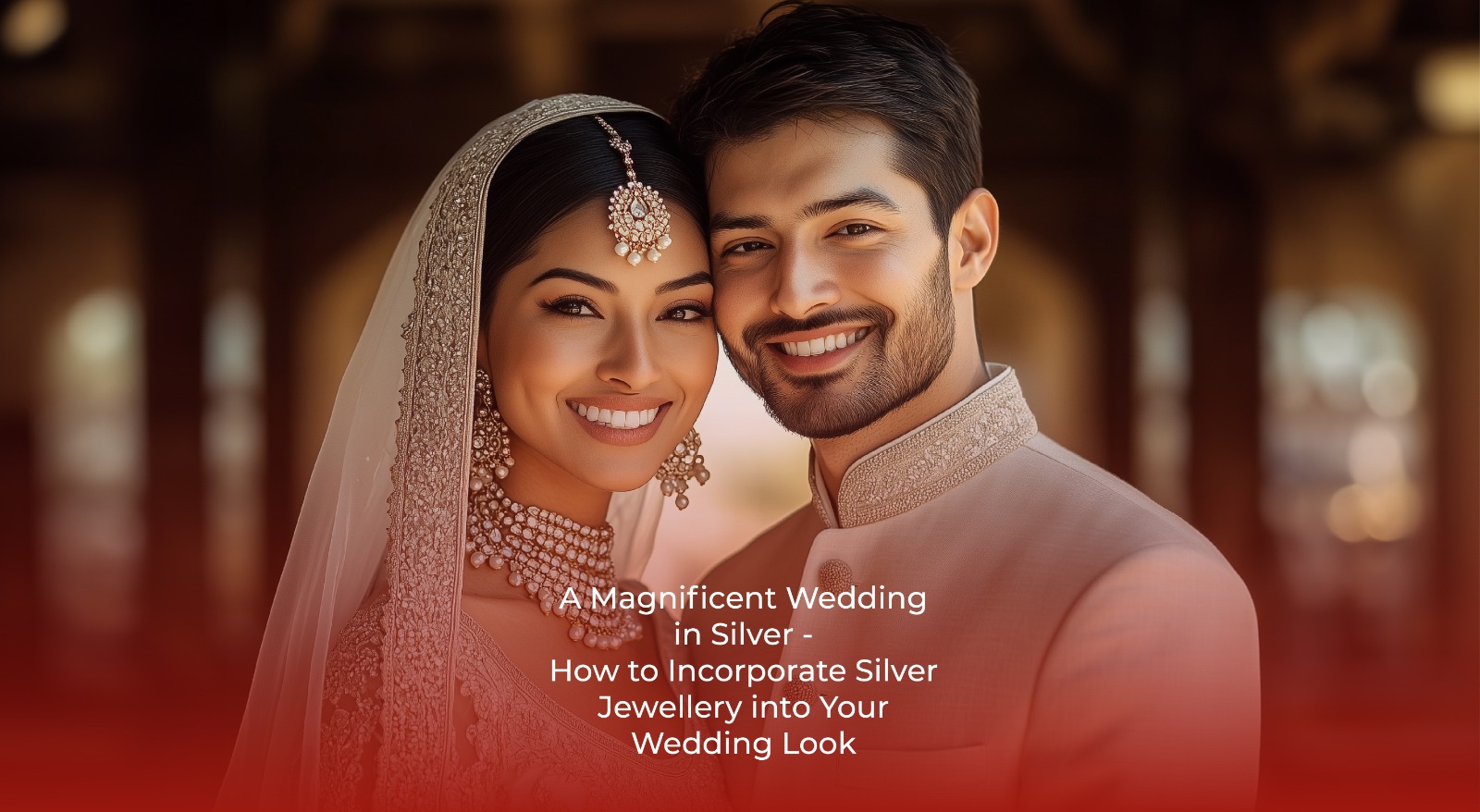

Choosing to invest under this programme means securing your financial commitment against the unpredictable movements of gold, silver, diamond, and platinum prices. Whether it’s planning for a wedding, commemorating an important anniversary, or celebrating any other significant event in your life and that of your loved ones, the Rate Protection Plan™ ensures your investments remain unaffected by market dynamics.

Understanding the Rate Protection Plan

The Rate Protection Plan™ is not merely a monthly savings scheme; it is a strategic investment tool designed to shield your gold purchases from market volatility while providing a structured path towards accumulating wealth. By allowing investments from as low as Rs.500 to Rs.1 lakh or more per month, the plan is accessible to a wide range of investors, from those just beginning their investment journey to seasoned investors looking to diversify their portfolio.

Key Features of the Plan

Averaged Rates: One of the standout features of the Rate Protection Plan™ is the averaged rate benefit, which calculates your gold rate based on the average of rates over a specific period. This mechanism is designed to protect your investments from the short-term fluctuations in gold prices, ensuring a fair and balanced entry point into the market.

Special Day Rewards and Additional Benefits: Recognising the personal value of gold investments, the plan offers added perks for your special days, along with additional benefits for on-time payments, further enhancing the value of your investment.

An Added 10% Per Annum Benefits: In a move that sets this plan apart from conventional savings schemes, investors enjoy an added 10% per annum benefit on their on-time monthly payments, substantially increasing the potential return on investment.Flexibility of Contributions: Whether you prefer the disciplined approach of monthly savings or the lump-sum method via a one-time payment plan, the Rate Protection Plan™ accommodates your individual financial strategy.

Why Choose the Rate Protection Plan?

Investing in gold through the Rate Protection Plan™ offers a multitude of advantages, chief among them being:

Zero Hidden Costs: With no management fees, entry, or exit loads, the plan stands as a testament to transparency and investor-friendly policies.

Proven Track Record: The scheme’s success over 25 years attests to its effectiveness as a reliable vehicle for gold investment.

Flexibility and Security: Offering a unique blend of flexibility in contributions and security against rate volatility, the plan addresses the common concerns associated with gold investment.

Investing in Gold in 2024

As the global economy continues to navigate uncertainties, gold remains a beacon of stability and security. The Rate Protection Plan™ by C. Krishniah Chetty Group of Jewellers represents the best way to invest in gold in 2024, providing a safeguarded, growth-oriented pathway to building your gold reserves.

How to Enroll?

Enrolling in the Rate Protection Plan™ offered by C. Krishniah Chetty Group of Jewellers can indeed be a wise move for those looking to invest in gold with an eye towards future security and potential growth. By locking in for an 11-month period with a plan for redemption in 2025, investors are taking a proactive step towards financial planning and investment in a commodity that has historically held its value well over time.

Visit the official C. Krishniah Chetty Group of Jewellers website here

Find the Rate Protection Plan™ under their investment schemes and follow the steps to enroll.

Remember, investing in your future starts with a single step, and the Rate Protection Plan™ could be that golden step towards securing a prosperous 2025.